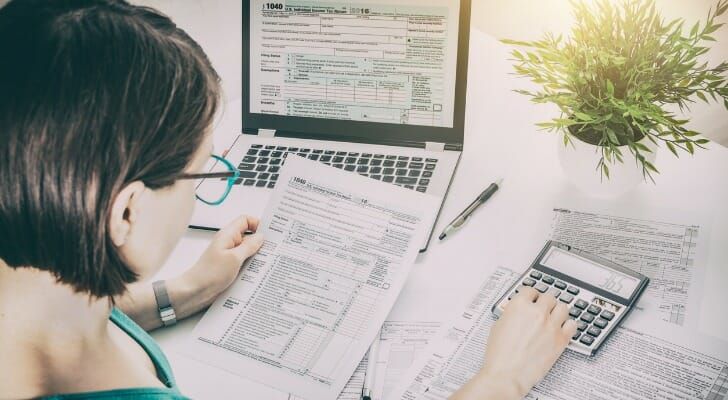

Tax Exemption Scheme for New Start-Up Companies 新成立公司免税计划 The tax exemption scheme for new start-up companies was introduced in Year of Assessment (YA) 2005 to support entrepreneurship and help our local enterprises grow. 为支持创业精神,帮助本地企业成长,新开办公司免税计划于2005年推行。 As other support for companies to build capabilities is being strengthened, it was announced in Budget 2018 that the tax exemption […]