What is Disallowed Input Tax Claims?

什么是不允许的进项税报销 ?

There are some Goods & Services Tax (GST) you can’t claim even though you have already paid for it when you made your purchases or expenses. Those GST you can’t claim is called Disallowed Input Tax Claims.

有一些商品及服务税(GST)你不能报销 ,即使你已经支付了它时,你作出你的购买或支出。那些您不能申请的商品及服务税被称为不允许的进项税报销 。

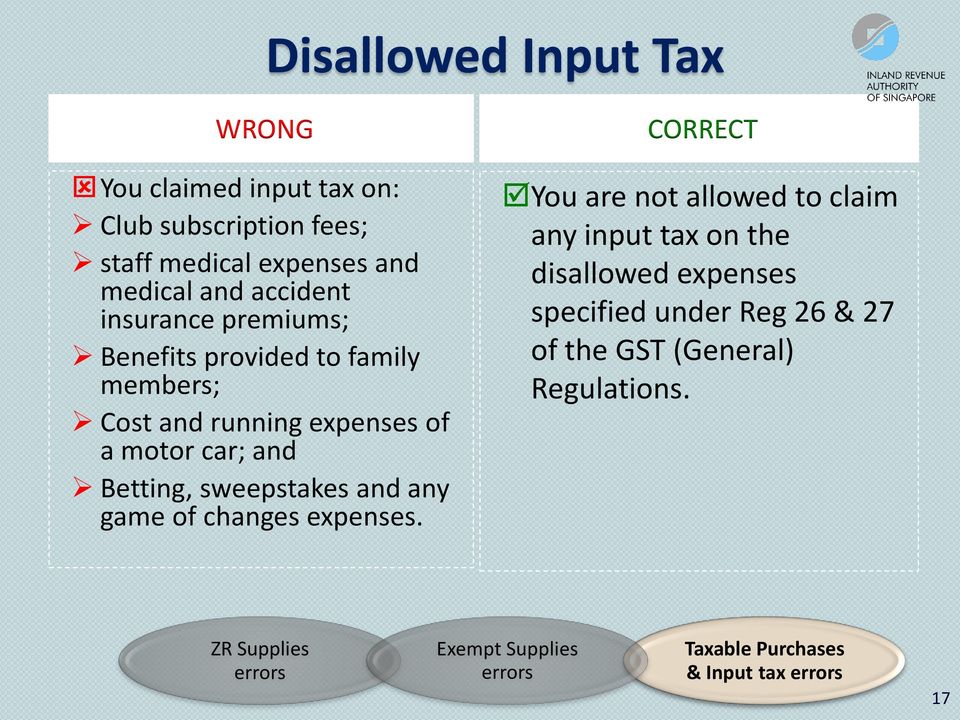

No Input Tax Credit is available for the following:

• Benefits provided to the family members or relatives of your staff;

• Costs and running expenses incurred on motor cars that are either:

- registered under the business’ or individual’s name, or

- hired for business or private use.

• Club subscription fees (including transfer fees) charged by sports and recreation clubs;

• Medical expenses incurred for your staff unless they are obligatory under the Work Injury Compensation Act or under any collective agreement within the meaning of the Industrial Relations Act;

• Medical and accident insurance premiums incurred for your staff unless the insurance or payment of compensation is obligatory under the Work Injury Compensation Act or under any collective agreement within the meaning of the Industrial Relations Act; and

• Any transaction involving betting, sweepstakes, lotteries, fruit machines or games of chance.

以下情况不提供进项税额报销 :

- 向员工家属或亲属提供的福利;

- 汽车产生的成本和运行费用:

- 以企业或个人名义注册,或

- 用于商业或私人用途。

- 体育和娱乐俱乐部收取的俱乐部订阅费(包括转让费);

- 员工的医疗费用,除非根据《工伤赔偿法》或《劳资关系法》所指的任何集体协议,这些费用是强制性的;

- 员工的医疗和意外保险费,除非根据《工伤赔偿法》或《劳资关系法》所指的任何集体协议,保险或赔偿金是强制性的;以及

- 任何涉及赌博、抽奖、彩票、水果机或机会游戏的交易。