Bank Reconciliation 银行对账

Differences between the bank statement and the cash book 银行对账单和现金簿之间的差异

When attempting to reconcile the cash book with the bank statement, there are three differences between the cash book and bank statement: 当试图将现金簿与银行对账单核对时,现金簿与银行对账单之间有三个不同之处:

- unrecorded items 没有记录的项目

- timing differences 时间的差异

- errors 错误

*Unrecorded items 没有记录的项目

These are items which arise in the bank statements before they are recorded in the cash book. Such ‘unrecorded items’ may include: 这些项目在银行对账单中出现,然后才记录在现金簿中。这些“未记录项目”可能包括:

- Interest 利息

- bank charges 银行费用

- dishonoured cheques. 空头支票。

They are not recorded in the cash book simply because the business does not know that these items have arisen until they see the bank statement. 他们没有记录在现金簿上,只是因为企业不知道这些项目已经出现,直到他们看到银行对账单。

*Timing differences: 时间差异:

These items have been recorded in the cash book, but due to the bank clearing process have not yet been recorded in the bank statement: 这些项目已经记录在现金簿上,但由于银行清算过程尚未记录在银行对账单上:

- Outstanding/unpresented cheques (cheques sent to suppliers but not yet cleared by the bank). 未兑现的支票(寄给供应商但银行尚未兑现的支票)。

- Outstanding/uncleared lodgements (cheques received by the business but not yet cleared by the bank). 未清的存款(企业收到但银行尚未清的支票)。

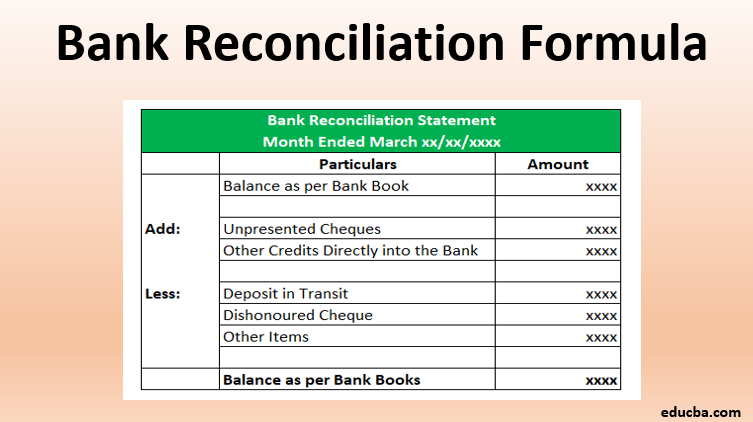

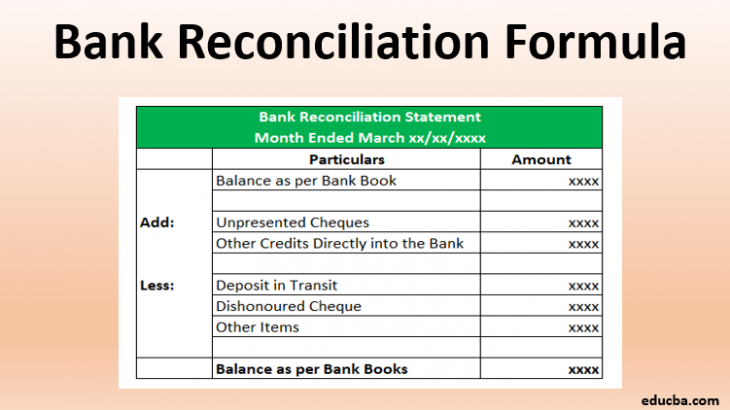

- The bank statement balance needs to be adjusted for these items: 以下项目需要调整银行对账单余额:

S$

Balance per bank statement X 银行结单的结余

Less: Outstanding/unpresented cheques (X) 减: 未兑现支票

Add: Outstanding/uncleared lodgements X 加: 未清的存款

–––

Balance per cash book (revised) X 据现金簿结余(修订)

*Errors in the cash book 现金簿上的错误

The business may make a mistake in their cash book. The cash book balance will need to be adjusted for these items. 企业可能会在他们的现金簿上出错。现金账户余额需要对这些项目进行调整。

*Errors in the bank statement 银行对账单错误

The bank may make a mistake, e.g. record a transaction relating to a different person within our business’ bank statement. The bank statement balance will need to be adjusted for these items. 银行可能会犯错,例如在业务的银行结单内记录一宗涉及不同人士的交易。这些项目需要调整银行对账单余额。

Outstanding payments and receipts 未付款项及收据

*Outstanding or unpresented cheques 未兑现的支票

Suppose a cheque relating to a payment to a supplier of a company is written, signed and posted on 29 June. It is also entered in the cash book on the same day. By the time the supplier has received the cheque and paid it into his bank account, and by the time his bank has gone through the clearing system, the cheque does not appear on the sender’s statement until, say, 6 July. The sender would regard the payment as being made on 29 June and its cash book balance as reflecting the true position at that date. 假设一张与支付给某公司供应商有关的支票是在6月29日写好,签好并寄出的。当天也记入现金簿。当供应商收到支票并将其支付到他的银行账户时,当他的银行通过清算系统时,支票才会出现在发送人的对账单上,比如7月6日。发件人将认为付款是在6月29日支付的,其现金帐面余额反映了该日期的真实情况。

*Outstanding deposits/lodgements 未清的存款

In a similar way, a trader may receive cheques by post on 30 June, enter them in the cash book and pay them into the bank on the same day. Nevertheless, the cheques may not appear on the bank statement until 2 Jul. Again the cash book would be regarded as showing the true position. Outstanding deposits are also known as outstanding lodgements. 同样地,一个贸易商可以在6月30日收到支票,将支票记入现金帐,并在当天存入银行。然而,支票可能要到7月2日才能出现在银行对账单上。同样,现金帐簿将被视为显示真实情况。未付存款也称为未付寄存。

More Explanation 更多的解释

See most of the differences between the bank statement and the cash book balances will be due to timing differences. 可见,银行对账单与现金账面余额之间的大部分差异将是由于时间差异造成的。

A cashier may send cheques out to suppliers, some of whom may pay in the cheque at the bank immediately while others may keep the cheque for several days before paying it in. 出纳员可以将支票寄给供应商,其中一些供应商可以立即在银行用支票付款,而另一些供应商则在付款前将支票保留几天。

When this happens the cashier will have recorded all the payments in the cash book. However, the bank records will only show the cheques that have actually been paid in by the suppliers and deducted from the business bank account. 当这种情况发生时,收银员会将所有的付款记录在现金簿上。然而,银行记录只会显示由供应商实际支付并从商业银行账户中扣除的支票。

These cheques are known as unpresented cheques. Okay ? 这些支票被称为未兑现支票。明白?

Now outstanding lodgements represent another type of timing difference. Here the firm’s cashier records a receipt in the cash book as he or she prepares the bank paying-in slip. However, the receipt may not be recorded by the bank on the bank statement for a day or so, particularly if it is paid in late in the day (when the bank will put it into the next day’s work), or if it is paid in at a bank branch other than the one at which the account is maintained 现在未清的存款代表了另一种类型的时间差异。在这里,公司的收银员在现金簿上记录收据,他或她准备银行付款凭条。但是,银行在一天左右的时间内不得将收据记录在银行对账单上,特别是如果收据是在当天晚些时候支付的(银行将把它放在次日的工作中),或者如果收据是在银行分行支付的,而不是在其开户行。