IAS 24 — Related Party Disclosures IAS 24 -关联方披露

Overview 概述

IAS 24 Related Party Disclosures requires disclosures about transactions and outstanding balances with an entity’s related parties. The standard defines various classes of entities and people as related parties and sets out the disclosures required in respect of those parties, including the compensation of key management personnel. 国际会计准则第24号关联方披露要求披露实体关联方的交易和未偿余额。该标准将各类实体和个人定义为关联方,并规定了对这些关联方的披露要求,包括关键管理人员的薪酬。

IAS 24 was reissued in November 2009 and applies to annual periods beginning on or after 1 January 2011. 国际会计准则第24号于2009年11月重新发布,适用于2011年1月1日或之后的年度期间。

Summary of IAS 24 国际会计准则第24号摘要

Objective of IAS 24 国际会计准则24的目标

The objective of IAS 24 is to ensure that an entity’s financial statements contain the disclosures necessary to draw attention to the possibility that its financial position and profit or loss may have been affected by the existence of related parties and by transactions and outstanding balances with such parties. 国际会计准则第24号的目标是确保一个实体的财务报表载有必要的披露,以提请注意其财务状况和损益可能受到关联方的存在以及与关联方之间的交易和未付余额的影响的可能性。

Who are related parties? 谁是关联方?

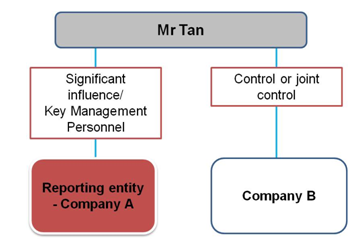

A related party is a person or entity that is related to the entity that is preparing its financial statements (referred to as the ‘reporting entity’) [IAS 24.9]. 关联方是与编制财务报表的实体(简称“报告实体”)相关的个人或实体[国际会计准则第24.9号]。

(a) A person or a close member of that person’s family is related to a reporting entity if that person: 一个人或其家庭的亲密成员与报告实体有关联,如果该人:

- has control or joint control over the reporting entity; 对报告单位有控制权或者共同控制权;

- has significant influence over the reporting entity; or 对报告单位有重大影响的;或

- is a member of the key management personnel of the reporting entity or of a parent of the reporting entity. 是报告实体的关键管理人员或报告实体的上级的成员。

(b) An entity is related to a reporting entity if any of the following conditions applies: 如适用下列任何条件,则实体与报告实体有关:

- The entity and the reporting entity are members of the same group (which means that each parent, subsidiary and fellow subsidiary is related to the others). 实体和报告实体是同一集团的成员(这意味着每个母公司、子公司和其它子公司都是相互关联的)。

- One entity is an associate or joint venture of the other entity (or an associate or joint venture of a member of a group of which the other entity is a member). 一个实体是另一个实体的联营或合资企业(或另一个实体是其成员的集团成员的联营或合资企业)。

- Both entities are joint ventures of the same third party. 两个实体都是同一第三方的合资企业。

- One entity is a joint venture of a third entity and the other entity is an associate of the third entity. 一个实体是第三个实体的合资企业,另一个实体是第三个实体的联营企业。

- The entity is a post-employment defined benefit plan for the benefit of employees of either the reporting entity or an entity related to the reporting entity. If the reporting entity is itself such a plan, the sponsoring employers are also related to the reporting entity. 该实体是为报告实体或与报告实体相关的实体的雇员提供的离职后固定福利计划。如果报告实体本身就是这样一个计划,赞助雇主也与报告实体有关。

- The entity is controlled or jointly controlled by a person identified in (a). 实体由(a)中指明的人控制或共同控制。

- A person identified in (a)(1) has significant influence over the entity or is a member of the key management personnel of the entity (or of a parent of the entity). (A)(1)项所列人员对实体有重大影响,或为实体的主要管理人员(或实体的母公司)。

- The entity, or any member of a group of which it is a part, provides key management personnel services to the reporting entity or to the parent of the reporting entity. 该实体或其所属集团的任何成员向报告实体或其母公司提供关键管理人员服务。

The following are deemed not to be related: [IAS 24.11] 下列各项被认为不相关:[国际会计准则第24.11号]

- two entities simply because they have a director or key manager in common 两个实体仅仅因为它们有一个共同的主管或关键经理

- two venturers who share joint control over a joint venture 共同控制一家合资企业的两个合资者

- providers of finance, trade unions, public utilities, and departments and agencies of a government that does not control, jointly control or significantly influence the reporting entity, simply by virtue of their normal dealings with an entity (even though they may affect the freedom of action of an entity or participate in its decision-making process) 不控制、共同控制或显著影响报告实体的财政、工会、公用事业以及政府部门和机构的提供者,仅仅因为他们与一个实体的正常交易(即使他们可能影响一个实体的行动自由或参与其决策过程)

- a single customer, supplier, franchiser, distributor, or general agent with whom an entity transacts a significant volume of business merely by virtue of the resulting economic dependence 单一客户、供应商、特许人、经销商或总代理,一个实体仅凭借由此产生的经济依赖性与之进行大量业务往来

What are related party transactions? 什么是关联方交易?

A related party transaction is a transfer of resources, services, or obligations between related parties, regardless of whether a price is charged. [IAS 24.9] 关联方交易是关联方之间的资源、服务或义务的转移,无论是否收取价格。(IAS 24.9)

Disclosure 信息披露

Relationships between parents and subsidiaries. Regardless of whether there have been transactions between a parent and a subsidiary, an entity must disclose the name of its parent and, if different, the ultimate controlling party. If neither the entity’s parent nor the ultimate controlling party produces financial statements available for public use, the name of the next most senior parent that does so must also be disclosed. [IAS 24.16] 母公司与子公司之间的关系。无论母公司与子公司之间是否存在交易,实体必须披露其母公司的名称,如果不同,则披露最终控制方的名称。如果该实体的母公司或最终控制方均未编制可供公众使用的财务报表,则还必须披露下一位最高级母公司的名称。[国际会计准则第24.16号]

Management compensation. Disclose key management personnel compensation in total and for each of the following categories: [IAS 24.17] 管理层薪酬。披露主要管理人员的薪酬总额以及以下每一类的薪酬:[IAS 24.17]

- short-term employee benefits 短期的员工福利

- post-employment benefits 离职后福利

- other long-term benefits 其它长期福利

- termination benefits 辞退福利

- share-based payment benefits 股份支付福利

Key management personnel are those persons having authority and responsibility for planning, directing, and controlling the activities of the entity, directly or indirectly, including any directors (whether executive or otherwise) of the entity. [IAS 24.9] 关键管理人员是指直接或间接地有权和责任规划、指导和控制实体活动的人员,包括实体的任何董事(无论是执行董事还是其他董事)。[国际会计准则第24.9号]

If an entity obtains key management personnel services from a management entity, the entity is not required to disclose the compensation paid or payable by the management entity to the management entity’s employees or directors. Instead the entity discloses the amounts incurred by the entity for the provision of key management personnel services that are provided by the separate management entity. [IAS 24.17A, 18A] 如果实体从管理实体获得关键管理人员服务,则该实体无需向管理实体的员工或董事披露管理实体支付或应付的薪酬。相反,该实体披露了该实体为提供由单独的管理实体提供的关键管理人员服务而发生的金额。[国际会计准则第24.17A、18A号]

Related party transactions. If there have been transactions between related parties, disclose the nature of the related party relationship as well as information about the transactions and outstanding balances necessary for an understanding of the potential effect of the relationship on the financial statements. These disclosure would be made separately for each category of related parties and would include: [IAS 24.18-19] 关联方交易。如果存在关联方之间的交易,披露关联方关系的性质以及了解该关系对财务报表的潜在影响所需的交易和未清余额的信息。这些披露将针对每一类关联方分别进行,包括:[IAS 24.18-19]

- the amount of the transactions 交易的金额

- the amount of outstanding balances, including terms and conditions and guarantees 未付余额的数额,包括条款、条件和担保

- provisions for doubtful debts related to the amount of outstanding balances 与未偿余额相关的坏账准备

- expense recognised during the period in respect of bad or doubtful debts due from related parties 在该期间确认的来自关联方的坏账或可疑债务的费用

A statement that related party transactions were made on terms equivalent to those that prevail in arm’s length transactions should be made only if such terms can be substantiated. [IAS 24.21] 只有在这些条款能够被证实的情况下,才应声明关联方交易的条款与公平交易中的条款相同。[国际会计准则第24.21号]